AR for Personal Finance: Visualizing spending habits and budgeting in real-time

AR for Personal Finance

Augmented reality (AR) is rapidly changing the way we interact with the world around us, and now it’s also making its way into personal finance. By overlaying digital information onto the real world, AR can provide a more engaging and intuitive way to manage our money.

AR for Personal Finance: Visualizing spending habits and budgeting in real-time

Augmented reality (AR) is rapidly changing the way we interact with the world around us, and now it’s also making its way into personal finance. By overlaying digital information onto the real world, AR can provide a more engaging and intuitive way to manage our money.

AR for Personal Finance

AR can revolutionize personal finance by offering interactive and visually appealing experiences. It can help us understand our spending habits better and make smarter financial decisions.

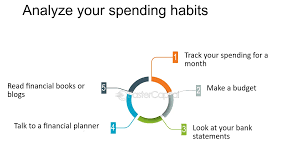

Visualizing spending habits

Imagine seeing a virtual representation of your spending displayed on your kitchen counter or in your living room. This is what AR can do. It allows you to visualize your spending habits in a more engaging and interactive way, helping you understand where your money is going.

AR can create interactive visualizations that show how much money you spend on different categories like groceries, entertainment, or utilities. You can even see a breakdown of your spending by month, week, or even day. This visual representation can make it easier to identify areas where you can cut back on spending or allocate your funds differently.

Real-time budgeting

AR can also help you with real-time budgeting. Imagine a virtual assistant that can tell you how much money you have left to spend for the day, week, or month. This real-time feedback can help you stay on track with your budget and avoid overspending.

AR apps can also help you set financial goals, such as saving for a down payment on a house or a dream vacation. You can see how much money you need to save and how long it will take you to reach your goals. This visual representation can help you stay motivated and focused on achieving your financial objectives.

As AR technology continues to develop, we can expect to see even more innovative applications for personal finance. AR could be used to create virtual financial advisors, provide personalized financial education, and even help you negotiate better deals on products and services.

Summary

- AR can help you visualize your spending habits in an engaging and interactive way.

- It can provide real-time budgeting information to help you stay on track.

- AR can help you set financial goals and see how much money you need to save to achieve them.